We will provide Article to present the “ Pcore” project to potential platform participants and those who are interested in contributing to its development. The information listed below may not be complete and does not imply any contractual relationship. The main purpose is to provide information to everyone, so that they can determine whether they are willing to analyze the company with the intention of obtaining token or invest.

Pcore aims to solve the obstacles and problems faced by modern companies when dealing with liquidity and financial uncertainty. In addition the main problems that disrupt a number of markets for some at regular bases are financial & factoring constraints, invoice verification, and non-transparent / outdated financial reports.

Hence, we at Pcore Ltd. offer a market that can significantly improve the liquidity of our business customers. Through the blockchain network, developed by our team, we offer a marketplace where receivable invoices can be sold securely. The platform enables businesses to connect, upload, and trade invoices, improving the liquidity rate of companies while providing a good investment ground for companies that seek safe funding projects

The hope of joining the This project is very big for us, before you join it will be better if you understand the project besides it will add to your insight and improve information for you especially understanding the project’s vision and mission so that it adds to your trust in.

Pcore is P2P (peer to peer) integrated in blockchain technology , with the aim of combining transparency, trust, speed and security of the blockchain with registered smart contracts and directly bringing together seller invoices and lenders.

Pcore aims to combine current technology into a niche but a growing market. As we all know, market conditions are currently experiencing difficult times. Because more and more businesses are turning to alternative funding other than banks, they are expected to be able to provide them with a platform that they can exchange their invoices in a faster way to get the amount they should. In return, help them grow, grow and keep up with business costs.

Solution

As a format for presenting financial data on a platform, we chose XBRL (eXtensible Business Reporting Language). This framework represents open international standards for digital business reporting. This is used throughout the world, with companies from more than 50 countries implementing it in their operations. Millions of XBRL documents are created every year, replacing older, paper-based reports with useful, effective and more accurate digital reports.

In other words, XBRL provides a language where the term reporting can be clearly defined. In turn, the term can then be used to uniquely represent financial report content or other types of compliance, performance, and business reports. XBRL is often called “bar code for reporting”, because it makes reporting more accurate and efficient. With unique tags, XBRL enables Pcore to develop its platform according to sophisticated market requirements, providing:

• usable reporting documents that can be registered, sorted, and analyzed automatically by Pcore

• the general belief that all reports in the follow-up platform are sophisticated, which have defined definition

In addition, comprehensive definitions and accurate data tags will help parties to carry out various reporting tasks, including:

• preparation

• validation

• publications

• exchanges

• consumption

• risk analysis and business information performance.

To enable the exchange of business report summaries, XBRL applies transaction tags on the platform. This transactional representation allows the exchange of independent systems and analysis of large amounts of supporting data. Thus, as a key to the transformation of financial reporting, the Pcore platform uses two core calculations to support investors in evaluating investment opportunities.

• usable reporting documents that can be registered, sorted, and analyzed automatically by Pcore

• the general belief that all reports in the follow-up platform are sophisticated, which have defined definition

In addition, comprehensive definitions and accurate data tags will help parties to carry out various reporting tasks, including:

• preparation

• validation

• publications

• exchanges

• consumption

• risk analysis and business information performance.

To enable the exchange of business report summaries, XBRL applies transaction tags on the platform. This transactional representation allows the exchange of independent systems and analysis of large amounts of supporting data. Thus, as a key to the transformation of financial reporting, the Pcore platform uses two core calculations to support investors in evaluating investment opportunities.

Our Finincials

For the purpose of the general financial health check, our income statement relies heavily on the user base. Due to the novelty of the idea, we expect that the number of clients will grow steadily in the future, which is reflected in our financial report. Detailed income statement can be found in Appendix A while user-base growth table on Appendix B.

Our financial model relies on several streams of revenues, upon which we have built our expectations. Namely, we evaluated invoices from sellers at £5,000. We take into account that 20 out of 100 users would opt for “cover” services, out of which 20 users that have taken cover 5 would not meet payments due date. Thus, we have 20% revenues obtained through commissions and fees related to “cover” transactions.

Additionally, as we expect year 1 to be the period of investment, there are important milestones and facts that we need to address. These include:

Technology year 1 includes construction of UK-based site, while year 2 consists of updating the UK platform and construction of Chinese online platform

The Pcore cover payout is for invoices that have been covering by the score. The seller cannot retrieve payment in time reasoning in payout to investors

Commission 2% for using invoice selling platform

Pcore cover where seller chooses to use invoice cover. Charge percentage depends on the overall invoice value

Pcore cover payout return is for invoices that have opted for cover and invoice seller returns Pcore Interested 8% represents interest gained from overdue invoice cover payment

Monthly Fee charge is reserved only for the Chinese platform, with a launch planned on the 4th month of year 2

We expect sharp incline of net income at the end of the second year of operations, with both UK and China markets contributing to growth. The overall income surge we expect stands at 368%, driven by the increased number of clients and P2P transactions. Furthermore, we expect a yearly increase in net income between 500% and 1,000% by the end of year 6, when compared to year 2.

Whereas fixed costs remain stable, due to the increased number of clients, variable costs, Cover Payout expenses especially, will grow proportionately. Thus, it is no wonder that variable costs will overgrow fixed expenses by the end of the second year.

Our financial model relies on several streams of revenues, upon which we have built our expectations. Namely, we evaluated invoices from sellers at £5,000. We take into account that 20 out of 100 users would opt for “cover” services, out of which 20 users that have taken cover 5 would not meet payments due date. Thus, we have 20% revenues obtained through commissions and fees related to “cover” transactions.

Additionally, as we expect year 1 to be the period of investment, there are important milestones and facts that we need to address. These include:

Technology year 1 includes construction of UK-based site, while year 2 consists of updating the UK platform and construction of Chinese online platform

The Pcore cover payout is for invoices that have been covering by the score. The seller cannot retrieve payment in time reasoning in payout to investors

Commission 2% for using invoice selling platform

Pcore cover where seller chooses to use invoice cover. Charge percentage depends on the overall invoice value

Pcore cover payout return is for invoices that have opted for cover and invoice seller returns Pcore Interested 8% represents interest gained from overdue invoice cover payment

Monthly Fee charge is reserved only for the Chinese platform, with a launch planned on the 4th month of year 2

We expect sharp incline of net income at the end of the second year of operations, with both UK and China markets contributing to growth. The overall income surge we expect stands at 368%, driven by the increased number of clients and P2P transactions. Furthermore, we expect a yearly increase in net income between 500% and 1,000% by the end of year 6, when compared to year 2.

Whereas fixed costs remain stable, due to the increased number of clients, variable costs, Cover Payout expenses especially, will grow proportionately. Thus, it is no wonder that variable costs will overgrow fixed expenses by the end of the second year.

However, we do have cost efficiency plans to contain the cost per user, in order to bring forth income as promised. Thus, we plan to implement heavy scrutinization management systems that would allow us to keep “cover” expenses at the required level, with a minimum amount of defaults and bad debt as possible.

On the side of revenues, the main income drive remains to be “Cover” score revenues, constituting almost 64% of our entire revenue figures for both years. The said income channel is heavily reliant on the user base, which we expect to grow substantially, especially after the penetration of the Chinese market.

ON the side of users, as we increase our marketing expenditure and further penetrate the UK an Chinese markets, we expect sharp incline of newly registered accounts. Thus, the expected growth rate for year 2 stands at 604%, mainly due to the opening of the Chinese market.

We took into consideration that, although China’s marketplace would be larger, the overall revenue power of Chinese clients is lower. Thus, our model takes into consideration lower revenues, even though a larger number of users would come from China.

Lastly, funds will be used for 50% buyback of Pcore coin, which will be burned upon the purchase, to keep the market flowing seamlessly. We shall repeat the process until the entire market holds 1M Pcore PCC coin in circulation. Thus, we plan to achieve 1 million token markets by between years 4 and 5.

Pcore allows businesses and investors to trade regardless of their geographical location, eliminating the need for any third party. Through Pcore, it can also eliminate the need for third parties to help Pcore keep the cost of selling and buying invoices low and high speed. No need to wait longer, instant income to grow business and instant profits. And all invoices uploaded by the invoice seller are recorded on the Ethereum blockchain which eliminates errors and misuse. Businesses taken from the Pcore cover will guarantee the funds promised at that date due to investors.

ICO DETAIL

To join the bounty campaign please use this thread

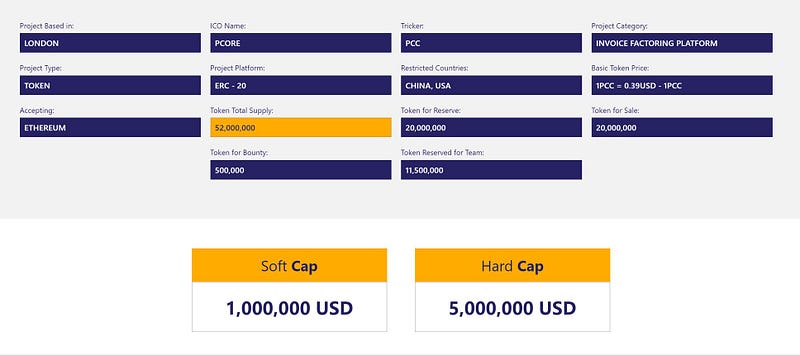

TOKEN DETAIL

Project Name: PCORE

Symbol: PCC

Category: Platform Factoring Factors

Type: Token

Platform: Erc20

Limited countries: China & US

PCC Base Token Price: 0.39 USD per 1 PCC

Payment: Ethereum

Total Token Supply: 52 Million Pieces

Reserve Token: 20 Million Pieces

Token For Sale: 20 Million Pieces

Gift Token: 500 Thousand Pieces

Tokens Reserved for Teams: 11 Million Pieces

Soft Cap: 1 Million USD

Hard Cap: 5 Million USD

Etherscan token info

Roadmap

Taking into account business development, we planned out an Initial coin Offering (ICO) as a channel of funding to build the necessary infrastructure for the Pcore invoice factoring platform. Using blockchain technology, we aim to build complete service and support teams that would carry out the necessary tasks of constructing, maintaining, and supporting the online marketplace.

The funds gained through the ICO would allow us to fund necessary operational activities, such as company offices, develop the trading platform, higher domestic and foreign professionals. At the starting stage, the only available currency shall be Pcore token, used for payments, fees, withdrawals, and deposits.

Should ICO commence successfully, the infrastructure would be developed within 2019, setting off the platform in a timely manner. Additionally, part of the pre-mined Pcore coins will serve as a reserve and bounty, while another portion will be held by the management team to ensure scaling opportunities.

As the market grows, we intend to list the token in external exchanges, to increase possible options for clients from around the globe. Thus, as a final stage, we intend to make core token tradable with any fiat currency in the world and attract top-notch companies to trade invoices within our platform.

Below is the planned supply of Pcore tokens:

The funds gained through the ICO would allow us to fund necessary operational activities, such as company offices, develop the trading platform, higher domestic and foreign professionals. At the starting stage, the only available currency shall be Pcore token, used for payments, fees, withdrawals, and deposits.

Should ICO commence successfully, the infrastructure would be developed within 2019, setting off the platform in a timely manner. Additionally, part of the pre-mined Pcore coins will serve as a reserve and bounty, while another portion will be held by the management team to ensure scaling opportunities.

As the market grows, we intend to list the token in external exchanges, to increase possible options for clients from around the globe. Thus, as a final stage, we intend to make core token tradable with any fiat currency in the world and attract top-notch companies to trade invoices within our platform.

Below is the planned supply of Pcore tokens:

For More Information You Can Visit Link Below :

Whitepaper: http://www.pcore.co/whitepaper

Twitter: https://twitter.com/PcorePCC

Author : Letty sits

Profile Link : https://bitcointalk.org/index.php?action=profile;u=1856247

Profile Link : https://bitcointalk.org/index.php?action=profile;u=1856247

Tidak ada komentar:

Posting Komentar